Who Benefits from a Multi-Cloud Market? A Trading Networks Based Analysis

Who Benefits from a Multi-Cloud Market? A Trading Networks Based Analysis

Segev Wasserkrug, Takayuki Osogami

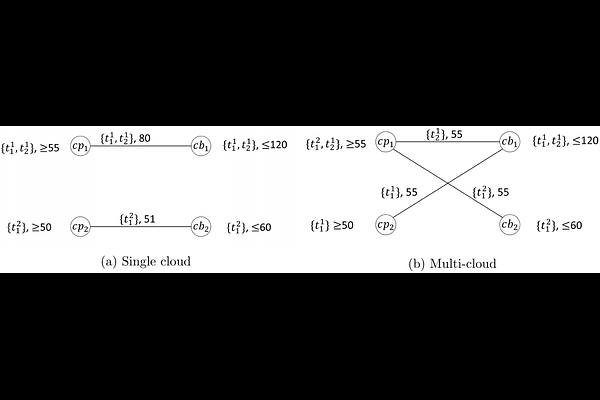

AbstractIn enterprise cloud computing, there is a big and increasing investment to move to multi-cloud computing, which allows enterprises to seamlessly utilize IT resources from multiple cloud providers, so as to take advantage of different cloud providers' capabilities and costs. This investment raises several key questions: Will multi-cloud always be more beneficial to the cloud users? How will this impact the cloud providers? Is it possible to create a multi-cloud market that is beneficial to all participants? In this work, we begin addressing these questions by using the game theoretic model of trading networks and formally compare between the single and multi-cloud markets. This comparson a) provides a sufficient condition under which the multi-cloud network can be considered more efficient than the single cloud one in the sense that a centralized coordinator having full information can impose an outcome that is strongly Pareto-dominant for all players and b) shows a surprising result that without centralized coordination, settings are possible in which even the cloud buyers' utilities may decrease when moving from a single cloud to a multi-cloud network. As these two results emphasize the need for centralized coordination to ensure a Pareto-dominant outcome and as the aforementioned Pareto-dominant result requires truthful revelation of participant's private information, we provide an automated mechanism design (AMD) approach, which, in the Bayesian setting, finds mechanisms which result in expectation in such Pareto-dominant outcomes, and in which truthful revelation of the parties' private information is the dominant strategy. We also provide empirical analysis to show the validity of our AMD approach.