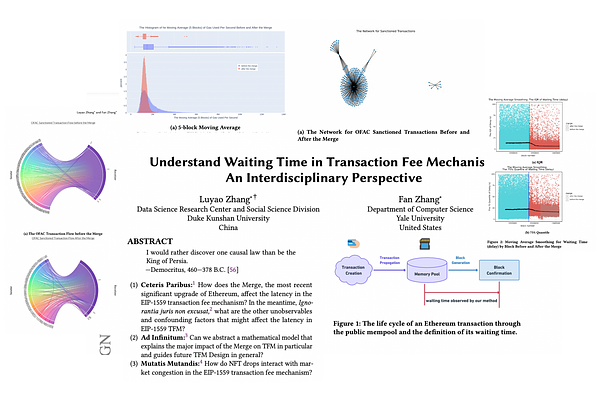

Understand Waiting Time in Transaction Fee Mechanism: An Interdisciplinary Perspective

Understand Waiting Time in Transaction Fee Mechanism: An Interdisciplinary Perspective

Luyao Zhang, Fan Zhang

AbstractBlockchain enables peer-to-peer transactions in cyberspace without a trusted third party. The rapid growth of Ethereum and smart contract blockchains generally calls for well-designed Transaction Fee Mechanisms (TFMs) to allocate limited storage and computation resources. However, existing research on TFMs must consider the waiting time for transactions, which is essential for computer security and economic efficiency. Integrating data from the Ethereum blockchain and memory pool (mempool), we explore how two types of events affect transaction latency. First, we apply regression discontinuity design (RDD) to study the causal inference of the Merge, the most recent significant upgrade of Ethereum. Our results show that the Merge significantly reduces the long waiting time, network loads, and market congestion. In addition, we verify our results' robustness by inspecting other compounding factors, such as censorship and unobserved delays of transactions via private changes. Second, examining three major protocol changes during the merge, we identify block interval shortening as the most plausible cause for our empirical results. Furthermore, in a mathematical model, we show block interval as a unique mechanism design choice for EIP1559 TFM to achieve better security and efficiency, generally applicable to the market congestion caused by demand surges. Finally, we apply time series analysis to research the interaction of Non-Fungible token (NFT) drops and market congestion using Facebook Prophet, an open-source algorithm for generating time-series models. Our study identified NFT drops as a unique source of market congestion -- holiday effects -- beyond trend and season effects. Finally, we envision three future research directions of TFM.

3 comments

scicastboard

1. How do the findings of this study impact the everyday user of the Ethereum network, and what benefits can they expect from the implementation of EIP-1559 and subsequent protocol changes?

2. In the paper, you mentioned that the Merge reduces the risks of long waiting time, network loads, and market congestion on Ethereum, with block interval shortening being the most plausible cause. Can you further discuss the potential trade-offs, if any, that might arise from these improvements in the transaction fee mechanism.

3. The paper presents an analysis of EIP-1559 and its impact on Ethereum, and also discusses the effects of NFT drops on market congestion. However, previous work by Budish et al. [Budish, E., Cramton, P., & Shim, J. (2014). The high-frequency trading arms race: Frequent batch auctions as a market design response. The Quarterly Journal of Economics, 130(4), 1547-1621.] focused on frequent batch auctions as a potential solution to market design issues. How does your analysis and proposed solutions compare to these previous works, and can they be integrated or adapted to address the challenges you've identified?

ScienceCast Board