Emergency Financing Tokens

Emergency Financing Tokens

Geoffrey Goodell

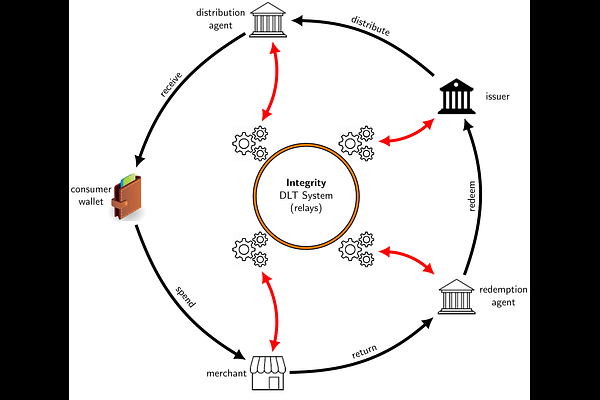

AbstractWe propose a novel payment mechanism for use by victims of large-scale conflict or natural disasters to conduct critical economic transactions and rebuild damaged infrastructure in the absence of both cash and traditional electronic payment mechanisms linked to bank accounts, such as debit cards or wire transfers. Claimants shall receive electronic tokens that can be used to pay registered businesses, such as purveyors of food and other basic goods, providers of essential services, and contractors to carry out construction tasks. The system shall be based upon the scalable architecture for retail payments described in our earlier work, which provides both strong privacy for consumers and strong compliance enforcement for recipients of funds. The system shall be designed to achieve three main objectives. First, tokens issued to claimants would be held directly by the claimants themselves, not via intermediaries, to avoid the risk of failure or subversion of asset custodians. Second, transactions shall not be traceable to the identity of the claimants, thus mitigating the risk that claimants can be pressured by service providers or other parties to reveal information that can be used to exploit them. Third, businesses and service providers that receive tokens shall be subject to rigorous compliance procedures upon redemption for cash or bank deposits, thus ensuring that only legitimate businesses or service providers can receive value from tokens, that token transfers will embed the identities of any recipients beyond the initial claimant, and that tax obligations shall be met at the time of redemption.