Online Mechanism Design with Predictions

Online Mechanism Design with Predictions

Eric Balkanski, Vasilis Gkatzelis, Xizhi Tan, Cherlin Zhu

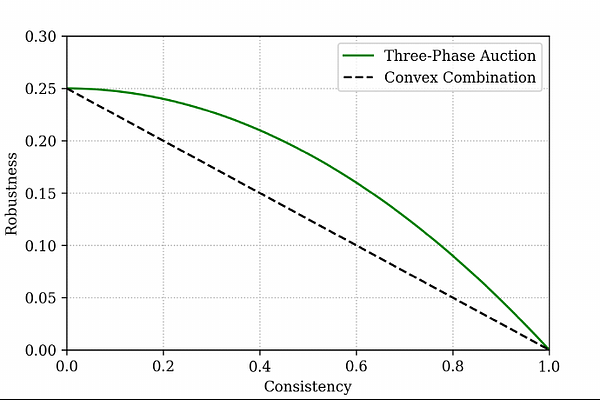

AbstractAiming to overcome some of the limitations of worst-case analysis, the recently proposed framework of "algorithms with predictions" allows algorithms to be augmented with a (possibly erroneous) machine-learned prediction that they can use as a guide. In this framework, the goal is to obtain improved guarantees when the prediction is correct, which is called \emph{consistency}, while simultaneously guaranteeing some worst-case bounds even when the prediction is arbitrarily wrong, which is called \emph{robustness}. The vast majority of the work on this framework has focused on a refined analysis of online algorithms augmented with predictions regarding the future input. A subsequent line of work has also successfully adapted this framework to mechanism design, where the prediction is regarding the private information of strategic agents. In this paper, we initiate the study of online mechanism design with predictions, which combines the challenges of online algorithms with predictions and mechanism design with predictions. We consider the well-studied problem of designing a revenue-maximizing auction to sell a single item to strategic bidders who arrive and depart over time, each with an unknown, private, value for the item. We study the learning-augmented version of this problem where the auction designer is given a prediction regarding the maximum value over all agents. Our main result is a strategyproof mechanism whose revenue guarantees are $\alpha$-consistent with respect to the highest value and $(1-\alpha^2)/4$-robust with respect to the second-highest value, for $\alpha \in [0,1]$. We show that this tradeoff is optimal within a broad and natural family of auctions, meaning that any $\alpha$-consistent mechanism in that family has robustness at most $(1-\alpha^2)/4$. Finally, we extend our mechanism to also achieve expected revenues proportional to the prediction quality.