By: Arnaud Cedric Kamkoum

This paper examines the monetary policies the Federal Reserve implemented in

response to the Global Financial Crisis. More specifically, it analyzes the

Federal Reserve's quantitative easing (QE) programs, liquidity facilities, and

forward guidance operations conducted from 2007 to 2018. The essay's detailed

examination of these policies culminates in an interrupted time-series (ITS)

analysis of the long-term causal effects of the QE progra... more

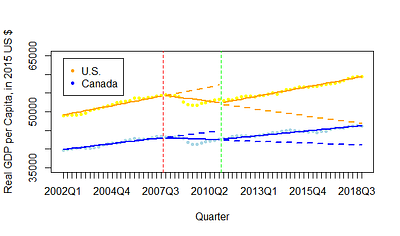

This paper examines the monetary policies the Federal Reserve implemented in

response to the Global Financial Crisis. More specifically, it analyzes the

Federal Reserve's quantitative easing (QE) programs, liquidity facilities, and

forward guidance operations conducted from 2007 to 2018. The essay's detailed

examination of these policies culminates in an interrupted time-series (ITS)

analysis of the long-term causal effects of the QE programs on U.S. inflation

and real GDP. The results of this formal design-based natural experimental

approach show that the QE operations positively affected U.S. real GDP but did

not significantly impact U.S. inflation. Specifically, it is found that, for

the 2011Q2-2018Q4 post-QE period, real GDP per capita in the U.S. increased by

an average of 231 dollars per quarter relative to how it would have changed had

the QE programs not been conducted. Moreover, the results show that, in 2018Q4,

ten years after the beginning of the QE programs, real GDP per capita in the

U.S. was 14% higher relative to what it would have been during that quarter had

there not been the QE programs. These findings contradict Williamson's (2017)

informal natural experimental evidence and confirm the conclusions of VARs and

new Keynesian DSGE models that the Federal Reserve's QE policies positively

affected U.S. real GDP. The results suggest that the current U.S. and worldwide

high inflation rates are likely not because of the QE programs implemented in

response to the financial crisis that accompanied the COVID-19 pandemic. They

are likely due to the unprecedentedly large fiscal stimulus packages used, the

peculiar nature of the financial downturn itself, the negative supply shocks

from the war in Ukraine, or a combination of these factors. This paper is the

first study to measure the macroeconomic effects of QE using a design-based

natural experimental approach.

less

By: Luyao Zhang, Fan Zhang

Blockchain enables peer-to-peer transactions in cyberspace without a trusted third party. The rapid growth of Ethereum and smart contract blockchains generally calls for well-designed Transaction Fee Mechanisms (TFMs) to allocate limited storage and computation resources. However, existing research on TFMs must consider the waiting time for transactions, which is essential for computer security and economic efficiency. Integrating data from t... more

Blockchain enables peer-to-peer transactions in cyberspace without a trusted third party. The rapid growth of Ethereum and smart contract blockchains generally calls for well-designed Transaction Fee Mechanisms (TFMs) to allocate limited storage and computation resources. However, existing research on TFMs must consider the waiting time for transactions, which is essential for computer security and economic efficiency. Integrating data from the Ethereum blockchain and memory pool (mempool), we explore how two types of events affect transaction latency. First, we apply regression discontinuity design (RDD) to study the causal inference of the Merge, the most recent significant upgrade of Ethereum. Our results show that the Merge significantly reduces the long waiting time, network loads, and market congestion. In addition, we verify our results' robustness by inspecting other compounding factors, such as censorship and unobserved delays of transactions via private changes. Second, examining three major protocol changes during the merge, we identify block interval shortening as the most plausible cause for our empirical results. Furthermore, in a mathematical model, we show block interval as a unique mechanism design choice for EIP1559 TFM to achieve better security and efficiency, generally applicable to the market congestion caused by demand surges. Finally, we apply time series analysis to research the interaction of Non-Fungible token (NFT) drops and market congestion using Facebook Prophet, an open-source algorithm for generating time-series models. Our study identified NFT drops as a unique source of market congestion -- holiday effects -- beyond trend and season effects. Finally, we envision three future research directions of TFM. less